yAudit Exit10 Review

Review Resources:

Auditors:

- spalen

- engn33r

Guest Auditor:

- securerodd (AfterDark Labs)

Table of Contents

- Review Summary

- Scope

- Code Evaluation Matrix

- Findings Explanation

- Critical Findings

- High Findings

- 1. High -

_getPercentFromTarget()called with incorrect argument - 2. High - Incorrect value in

_safeTokenClaim() - 3. High - bootstrapBucket fees are double counted in

claimAndDistributeFees() - 4. High - Reinvested bootstrap fees are counted as fee-earning liquidity immediately

- 5. High -

_depositAndSwap()should set non-zeroamountOutMinimumvalues - 6. High - Unconsumed allowance will break fee updates

- 7. High - Exit10.sol ignores token order when sending fees to FeeSplitter.sol

- 8. High - Potential loss of collected fees during the call to

claimAndDistributeFees()

- 1. High -

- Medium Findings

- 1. Medium - Using tick as price proxy is slightly inaccurate

- 2. Medium - Incorrect

EXIT_DISCOUNTvalues - 3. Medium - Problematic MasterchefExit rewards distribution to first EXIT staker

- 4. Medium - Griefer can force bootstrap depositors to lose all funds if exit10() is triggered during the bootstrap phase

- 5. Medium - Updating fees with zero amount can be used to dilute rewards

- 6. Medium - Pool spot price manipulation allows to call

exit10()before ETH reaches 10K

- Low Findings

- 1. Low - Use

_collect()return values - 2. Low - No emergency function(s) to handle edge cases

- 3. Low - Inelegant rounding solution

- 4. Low - Incentive tokens EXIT, BOOT exposed to frontrunning

- 5. Low - Incorrect

PROTOCOL_GUILDaddress for multichain deployment - 6. Low - High hardcoded slippage

- 7. Low - Bootstrap rewards are shared

- 8. Low - Possible loss of funds with price limited swaps through

DepositHelper

- 1. Low - Use

- Gas Savings Findings

- 1. Gas - Relying on hardcoded values can save gas

- 2. Gas - Unnecessary 1e18 decimals multiplication

- 3. Gas - Pass

_liquidityAmount()tocollectFees()for 2nd argument - 4. Gas - Remove function used only once

- 5. Gas - Remove unused variables

- 6. Gas - Remove unneeded variable

- 7. Gas - Struct packing

- 8. Gas - Skip double fetching of the same value

- 9. Gas - Use Shift Left instead of Multiplication if possible

- 10. Gas - Cache state variables

- 11. Gas - Redundant check in

cancelBond() - 12. Gas -

>=costs less gas than>.

- Informational Findings

- 1. Informational - Standardize ProcessEth implementation

- 2. Informational - Consider

else ifinstead ofelsefor stricter checks - 3. Informational - Possibly unnecessary event emit

- 4. Informational - Revert on zero case

- 5. Informational - Replace modifiers

- 6. Informational - Missing NatSpec

- 7. Informational - Use abstract contract

- 8. Informational - Solidity version

- 9. Informational - Non-descriptive variable and function names

- 10. Informational - Outdated documentation

- 11. Informational - Replace magic numbers with constants

- 12. Informational - Typos

- 13. Informational - Unclaimed rewards can be added to user’s reward debt

- 14. Informational - Remove unnecessary address casting

- 15. Informational - Remove unnecessary virtual marker

- 16. Informational - Potentially unnecessary line of code

- 17. Informational - (Out of scope file) Ensure that Bond NFT contract is initialized with non-zero

TRANSFER_LOCKOUT_PERIOD_SECONDS - 18. Informational - Potential lock funds if USDC implements taking fee mechanism in the future

- 19. Informational - Bonds may convert less EXIT tokens than users expect

- 20. Informational - Masterchef is vulnerable to reentrancy attacks

- 21. Informational - Event not emitted when adding a token.

- 22. Informational - Centralization risk during protocol bootstrap

- Final remarks

Review Summary

Exit10

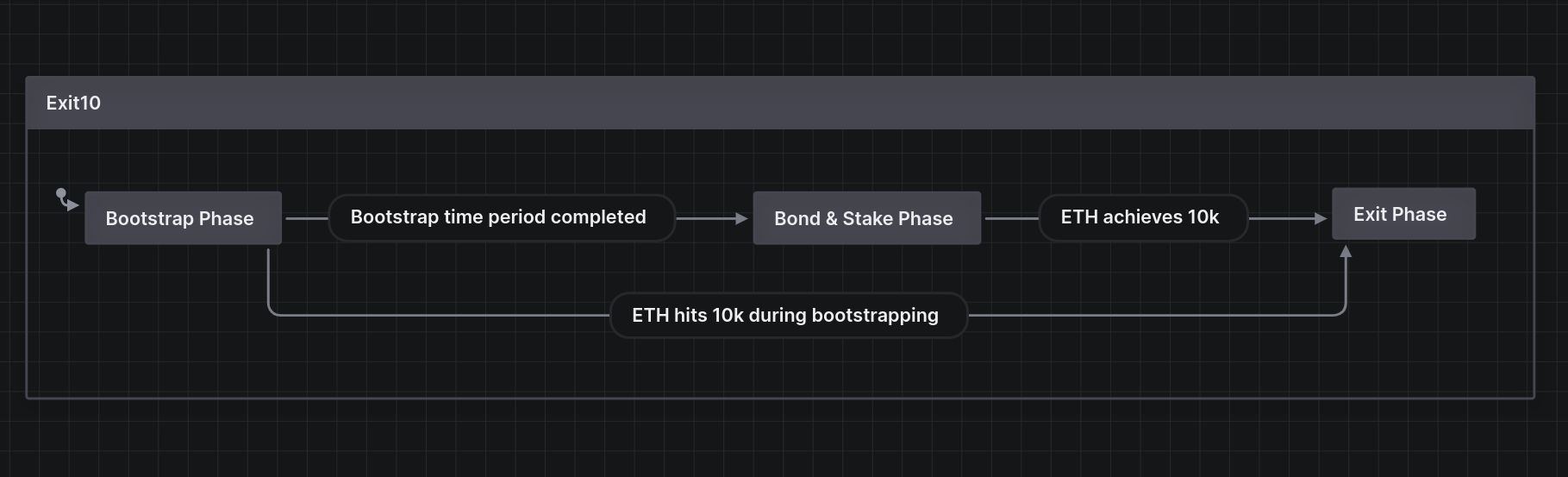

Exit10 provides a novel and gamified approach for users to gain exposure to and stack ETH as it increases to the price of $10K. This is done by depositing user funds into the WETH/USDC Uniswap v3 pool and holding the liquidity position in Exit10 to stack ETH over time. The fees received from the Uniswap v3 LP position fees are converted to WETH and stored in MasterChef rewards contracts to provide greater exposure to ETH price upside. The protocol will be deployed on Ethereum mainnet, Optimism, and Arbitrum.

The contracts of the Exit10 Repo were reviewed over 14 days. The code review was performed by 2 auditors between April 17 and April 30, 2023. Fellows from yAudit Block 5 additionally joined the review. The repository was under active development during the review, but the review was limited to the latest commit at the start of the review. This was commit 0b3c2782c5a93d2218234bc70fee31ec32f9e337 for the Exit10 repo. One file from the uniswap-v3-swapper repository at commit 4a3d2c9af49285b0e5cbdbe819f264c13241d017 was also in scope.

Scope

The scope of the review consisted of the following contracts at the specific commit:

- All contracts in the primary exit10-protocol repository with the exception of:

- Contracts related to STO token distribution (STOToken.sol, MerkleDistributor.sol)

- Contracts implementing custom ERC20 and ERC721 tokens (BaseToken.sol, NFT.sol)

- Swapper.sol in the uniswap-v3-swapper repository

After the findings were presented to the Exit10 team, fixes were made and included in several PRs.

This review is a code review to identify potential vulnerabilities in the code. The reviewers did not investigate security practices or operational security and assumed that privileged accounts could be trusted. The reviewers did not evaluate the security of the code relative to a standard or specification. The review may not have identified all potential attack vectors or areas of vulnerability.

yAudit and the auditors make no warranties regarding the security of the code and do not warrant that the code is free from defects. yAudit and the auditors do not represent nor imply to third parties that the code has been audited nor that the code is free from defects. By deploying or using the code, Exit10 and users of the contracts agree to use the code at their own risk.

Code Evaluation Matrix

| Category | Mark | Description |

|---|---|---|

| Access Control | Average | There are some functions that have access control modifiers for certain roles to perform special functions. Modifiers appear to be used properly and are not missing or overused. Some NFT.sol and FeeSplitter.sol call renounceOwnership() to remove any special owner privileges. |

| Mathematics | Good | There is no complex math in Exit10, only basic internal accounting math. Solidity 0.8.X is used so SafeMath is applied throughout. |

| Complexity | Low | The protocol design relies on some assumptions about the future of DeFi and some assumptions about how users wish to gain ETH exposure. There are design components borrowed from Chicken Bonds and used in a unique way that is arguably more complex that the original Chicken Bonds protocol. The mechanics of the 4 custom ERC20 tokens (BOOT, STO, BLP, EXIT) can be confusing, the accounting between the four liquidity buckets is complex, and the expected end result for early depositors and STO holders receive from accumulated fees is not transparently documented. Moving liquidity between buckets by modifying state variables right before using the updated liquidity values in calculations can cause fairness issues in cases where a cached liquidity value from before the update should be used instead. Some functions like _getExitAmount() could use refactoring and renaming. |

| Libraries | Average | Only OpenZeppelin external libraries were imported to Exit10. Additional code was borrowed from SushiSwap MasterChef and from ChickenBonds, but the borrowed code was also modified in ways that may potentially break assumptions that existed in the original code. |

| Decentralization | Good | There are no upgradeable proxies, the contracts are immutable, and after deployment the protocol does not have any centralized party that can control it. |

| Code stability | Average | The code was nearly ready to deploy on mainnet, but some last minute changes before the audit did introduce some bugs. |

| Documentation | Low | While there is a documentation website with high level docs, there is a severe lack of NatSpec in the contracts. This makes it difficult to understand developer assumptions and also makes the developer’s job more difficult when edits are required. |

| Monitoring | Average | Events were emitted in all functions where they would be useful, though at least one event emit may not be implemented in the best way possible. |

| Testing and verification | Average | Tests were running on a fork of Ethereum mainnet, but there were no tests to run on Optimism or Arbitrum despite plans to deploy the Exit10 protocol on all 3 chains. |

Findings Explanation

Findings are broken down into sections by their respective impact:

- Critical, High, Medium, Low impact

- These are findings that range from attacks that may cause loss of funds, impact control/ownership of the contracts, or cause any unintended consequences/actions that are outside the scope of the requirements

- Gas savings

- Findings that can improve the gas efficiency of the contracts

- Informational

- Findings including recommendations and best practices

Critical Findings

None.

High Findings

1. High - _getPercentFromTarget() called with incorrect argument

When _getPercentFromTarget() is defined, the input argument name is _amountBootstrapped. But when _getPercentFromTarget() is called from _getExitAmount(), the value passed is not an amount related to bootstrapping but instead is the liquidity that is left in the exit bucket when the user converts their bond to receive EXIT tokens. In other words, the wrong value is passed to _getPercentFromTarget().

Technical Details

_getPercentFromTarget() calculates a return value that represents a percent value. The calculation can be summarized as (x / bootstrapTargetLiquidity) * 100%. This ratio and the context of this line of coe indicates that x should be the current bootstrap liquidity held by the protocol. The current code does not use the current bootstrap liquidity value and therefore needs modification.

Impact

High.

Recommendation

Make this change to _getExitAmount() to provide the current bootstrap liquidity as the argument to _getPercentFromTarget().

- uint256 percentFromTaget = _getPercentFromTarget(_liquidity) <= 5000 ? 5000 : _getPercentFromTarget(_liquidity);

+ uint256 percentFromTaget = _getPercentFromTarget(bootstrapBucket) <= 5000 ? 5000 : _getPercentFromTarget(bootstrapBucket);

Developer Response

Fixed in commit 5bf6e76740d862c71a20feccd07ebb66872c27e7

2. High - Incorrect value in _safeTokenClaim()

A typo in _safeTokenClaim() uses the wrong variable in rewards calculations.

Technical Details

The ratio of rewards that a user can claim to the total rewards supply should be the same as the ratio of tokens that the user holds to the total token supply. This is how the _safeTokenClaim() logic works in the first step. The second step involves a correction to the rewards that a user can claim if the total claimed rewards exceed the total supply of rewards. This is how the logic should work, but this line of code actually checks if the total claimed rewards exceed the total supply of EXIT, BOOT, or other tokens. The total supply of tokens should not be involved in this calculation, the total supply of rewards should be used.

Impact

High. The incorrect variable is used in reward calculations in _safeTokenClaim().

Recommendation

Modify _safeTokenClaim() to fix the misused variable:

- _claim = (_claimed + _claim <= _supply) ? _claim : _supply - _claimed;

+ _claim = (_claimed + _claim <= _externalSum) ? _claim : _externalSum - _claimed;

Additionally, consider renaming the variables where _safeTokenClaim() is defined to clarify what each of them represents, for example:

_claim->_claimableRewards_claimed->_previouslyClaimedRewards_supply->_finalTotalSupply_externalSum->_rewardsFinalTotalSupply

Developer Response

Applied the recommended change in L3 where the check is not needed since we are rounding down on every claim. Fixed in commit afc424cbe293201f4665e6c05e11c81359b7aa7

3. High - bootstrapBucket fees are double counted in claimAndDistributeFees()

claimAndDistributeFees() reinvests bootstrap bucket earned fees into the Uniswap v3 LP position. But the bootstrap bucket liquidity is still counted in the later calculations of FeeSplitter.collectFees() which gives the bootstrap bucket more fees than it deserves.

Technical Details

To summarize the fee collection logic that is currently implemented in claimAndDistributeFees(), assume:

amountCollected0= 100bootstrapFees0= 10 (this implies bootstrap liquidity is 10% of the total Exit10 liquidity)amountCollected0passed toFeeSplitter.collectFees()= 90 (100 - 10 = 90)

The amount of fees passed to FeeSplitter.collectFees() is 90 (this is the amountCollected0 value from the previous calculation). This value is then distributed by the ratio of pending bucket’s liquidity over the total liquidity (the sum of liquidity of all buckets), which is 70%. If pendingBucket is 70% of liquidity while remainingBuckets are 30% of liquidity, then assuming the original 100 of fees, pendingBucket should get 70% of fees, in this example, 70 worth of fees. But because only 90 worth of fees is passed in collectFees(), pendingBucket instead gets 70% of 90, 63.

The result is that pendingBucket is penalized while the bootstrap bucket gets counted twice and effectively gets double fees.

Impact

High. The bootstrap bucket gets approximately double the fees that it should.

Recommendation

bootstrapBucket should be removed from the math on this line so that bootstrapBucket liquidity is excluded in the calculations that calculate the distribution of the remaining collected fees. The recommendation in the next high finding provides an improvement to fixing this issue individually.

Developer Response

Applied the fix together with H4 Fixed in commit 3d15e441fd5732facdd87b5407c15e0c60f0b303

4. High - Reinvested bootstrap fees are counted as fee-earning liquidity immediately

claimAndDistributeFees() reinvests bootstrap bucket fees into the Uniswap v3 LP position. After this liquidity is added, the liquidity will be counted towards the Exit bucket’s liquidity. Immediately after the liquidity is added, _exitBucket() will use the newly increased Exit bucket liquidity to calculate how fees should be split. But the newly added liquidity did not contribute to generating the fees that will be split, therefore this newly added liquidity will bias the fee distribution unfairly towards the Exit bucket at the expense of other buckets.

Technical Details

Exit10.claimAndDistributeFees() collects and distributes the Uniswap LP fees between the different buckets in the Exit10 protocol. This distribution of rewards is calculated using the liquidity share owned by each bucket. The more liquidity that a bucket owns, the more fees that the bucket deserves. But the total Uniswap v3 LP liquidity is increased in this function and the newly added liquidity did not contribute to generating the fees that were just collected. Therefore the value of Exit10._exitBucket() is greater than the Exit bucket liquidity that is responsible for generating the collected fees. This means that the Exit bucket will receive a larger share of fees than it should and other buckets will be penalized.

Impact

High. Users expecting to receive rewards from the pending bucket will not receive the expected amount of value.

Recommendation

This recommended fix includes a mitigation to the previous high finding and includes a gas optimization finding.

- Cache

_liquidityAmount()in a temporary variable such as_totalLiquidityBeforebefore the bootstrap fees are reinvested into the Uniswap LP position. - Replace the 2nd argument passed to

FeeSplitter.collectFees()with the following:

- bootstrapBucket + reserveBucket + _exitBucket(),

+ _totalLiquidityBefore - bootstrapBucket

Because the remainingBuckets argument in FeeSplitter.collectFees() will now equal the total Uniswap v3 LP liquidity before the reinvesting of bootstrap fees and excluding the bootstrap feed, the code in FeeSplitter.sol that handles the total liquidity value can be simplified. The new remainingBuckets value includes the pendingBucket liquidity, so this line which appears twice (1, 2) in FeeSplitter.collectFees() should be modified.

- pendingBucket + remainingBuckets,

+ remainingBuckets,

Developer Response

Applied the fix together with H3 Fixed in commit 3d15e441fd5732facdd87b5407c15e0c60f0b303

5. High - _depositAndSwap() should set non-zero amountOutMinimum values

To avoid MEV bot attacks, avoid using a zero value for the Uniswap amountOutMinimum values. The params variable returned by _depositAndSwap() is later used in _addLiquidity() to deposit liquidity into Uniswap.

Technical Details

Uniswap v3 docs have this to say about amountOutMinimum:

amountOutMinimum: we are setting to zero, but this is a significant risk in production. For a real deployment, this value should be calculated using our SDK or an onchain price oracle - this helps protect against getting an unusually bad price for a trade due to a front running sandwich or another type of price manipulation

Exit10 sets a amountOutMinimum value of zero in several places, including in _depositAndSwap() and claimAndDistributeFees(). There is a risk of value loss due to MEV bots when the minimum value is set to zero.

Impact

High. Poorly chosen amountOutMinimum values can lead to loss of value from MEV bots.

Recommendation

Follow the recommendation from the Uniswap docs to use an on-chain price oracle or the value calculated by the SDK. If these options are too gas intensive, consider an approach using a hardcoded acceptable slippage value of roughly 0.3% to at least minimize the MEV losses.

Developer Response

Fixed in commit 4ba3a842a71bd4c9395c48c4f0b83c50aedd3332

6. High - Unconsumed allowance will break fee updates

The FeeSplitter.sol is responsible for redirecting rewards to two of the masterchef staking contracts. When updating rewards for these contracts, it uses Swapper.sol to swap USDC for WETH. There is a chance that during one of these swaps, Swapper.sol will not fully consume the allowance it sets using safeApprove. If this happens, the FeeSplitter will no longer be able to distribute rewards that it collects.

Technical Details

When the FeeSplitter is updating the rewards for the masterchef contracts, it first swaps USDC for WETH. This in turn calls swap() in Swapper.sol. This function uses safeApprove to give the Uniswap V3 Router permission to spend all of the USDC the FeeSplitter has given the Swapper. Importantly, the Swapper also creates a price limit and adds this as parameter in its call to the Uniswap V3 Router.

The problem in this case combines two related truths:

- safeApprove requires that the previous allowance be completely spent or that it is called with a 0 value. Under any other circumstance it will revert.

- There is a non-zero chance that the call to the Uniswap V3 Router will not consume the entire allowance set by the call to safeApprove.

Uniswap V3 Router’s exactInputSingle function, which is what was called by the Swapper, calls exactInputInternal which itself calls swap directly on the pool with the provided parameters. As mentioned earlier, a price limit was included among these parameters.

The swap function in Uniswap V3 then swaps in steps until it either has used the entire amountIn or it hits the price limit specified. If it hits the price limit specified before it hits the amountIn, there will be an unconsumed allowance and all subsequent calls to the Swapper’s swap function will fail.

Impact

High. The system relies on the FeeSplitter to distribute rewards. Once an unconsumed allowance occurs, all fees collected and sent to the FeeSplitter will become inaccessible.

Recommendation

safeApprove is deprecated and not recommended for use in production since OpenZeppelin library version 3.1.0 because of the subtle risks it poses. Consider using safeIncreaseAllowance instead.

If you do wish to continue using safeApprove, ensure that you call safeApprove with a value of 0 each time before you call it with the desired allowance for the swap.

Developer Response

Fixed in commit e41100bcc401e8e0e9d4d417019e9d58b5a69f12

7. High - Exit10.sol ignores token order when sending fees to FeeSplitter.sol

The claimAndDistributeFees() function always assumes that the token0 from the Uniswap pool matches the “token out” and that token1 matches the “token in”.

Technical Details

The call to collect() in the Uniswap pool will return collected fees as amount0 and amount1 which corresponds to the token0 and token1 of the pool.

These amounts are eventually forwarded to the call to collectFees() in the FeeSplitter.sol contract. The third and fourth arguments are amountTokenOut and amountTokenIn, amountTokenOut should correspond to the “token out” (USDC) while amountTokenIn should correspond to the “token in” (ETH). The order here is important because FeeSplitter.sol use amountTokenOut as transfer amount for USDC.

However, claimAndDistributeFees() ignores this order and simply sends amountCollected0 as amountTokenOut and amountCollected1 as amountTokenIn.

This will work on Ethereum mainnet as the address of USDC is lower than the address of WETH, meaning token0 is “token out”, but will fail on Optimism where the address of USDC is greater than the address of WETH.

The following test simulates an scenario where token0 is WETH and token1 is USDC by forking Optimism. The call to claimAndDistributeFees() will revert as FeeSplitter.sol will try to pull more funds than available from the Exit10.sol contract. Full test suite is available here.

function test_Exit10_claimAndDistributeFees_IncorrectTokenOrder() public {

// We are on optimism where the token0/1 order in inverse to mainnet

setUpOptimism();

// Skip bootstrap phase

_skipBootstrap();

// Create a bond to provide some liquidity

weth.approve(address(exit10), type(uint256).max);

usdc.approve(address(exit10), type(uint256).max);

deal(address(weth), address(this), 10 ether);

deal(address(usdc), address(this), 10_000e6);

_createBond(10 ether, 10_000e6);

// Do some swaps to generate fees

weth.approve(UNISWAP_V3_ROUTER, type(uint256).max);

usdc.approve(UNISWAP_V3_ROUTER, type(uint256).max);

_generateFees(usdc, weth, 1e12);

// This function will claim fees from the pool and call collectFees() in FeeSplitter.

// FeeSplitter will try to pull the tokens from Exit10 but will fail since the token order is wrong,

// the call to collectFees() sends the USDC amount as the WETH amount and the WETH amount as the

// USDC amount. As these amounts represent different magnitudes, the transaction will be reverted

// since the Exit10 contract won't have those balances. For example, if fees are 500 USDC it will

// try to pull 500 WETH from the Exit10 contract.

vm.expectRevert("ERC20: transfer amount exceeds balance");

exit10.claimAndDistributeFees();

}

Impact

High. Ignoring the token order in FeeSplitter.sol will cause the function collectFees() to revert on some chains.

Recommendation

Add this code before calling collectFees() in `claimAndDistributeFees():

if (POOL.token0() != TOKEN_OUT) {

uint256 temp = amountCollected0;

amountCollected0 = amountCollected1;

amountCollected1 = temp;

}

Developer Response

Fixed in commit d8df0f461cff3a9c6cb2f0876a5a61c25b648202

8. High - Potential loss of collected fees during the call to claimAndDistributeFees()

Fees collected during the call to claimAndDistributeFees() in Exit10.sol will be stuck in the contract when the call to increaseLiquidity() fails.

Technical Details

When claimAndDistributeFees() is called, the function will collect fees from the Uniswap pool, which will send the funds to the caller contract. The implementation will then try to compound the proportion corresponding to the bootstrap bucket using increaseLiquidity():

https://github.com/open-bakery/exit10-protocol/blob/0b3c2782c5a93d2218234bc70fee31ec32f9e337/src/Exit10.sol#L439-L457

439: try

440: INPM(NPM).increaseLiquidity(

441: INPM.IncreaseLiquidityParams({

442: tokenId: positionId,

443: amount0Desired: bootstrapFees0,

444: amount1Desired: bootstrapFees1,

445: amount0Min: 0,

446: amount1Min: 0,

447: deadline: DEADLINE

448: })

449: )

450: returns (uint128, uint256 amountAdded0, uint256 amountAdded1) {

451: unchecked {

452: amountCollected0 -= amountAdded0;

453: amountCollected1 -= amountAdded1;

454: }

455: } catch {

456: return;

457: }

The external call is wrapped in a try/catch statement. The main issue is that if the call to increaseLiquidity() fails then the catch block will simply return from the function, which means the call to claimAndDistributeFees() will succeed. However, funds from fees have been already claimed but won’t be sent to the FeeSplitter.sol contract.

Additionally, this issue can be exploited by a bad actor using EIP-150 and the “rule of 1/64th”. A bad actor can carefully choose the gas limit to make the call to increaseLiquidity() fail due out of gas, while still saving some gas in the main context to continue execution. The call to increaseLiquidity() will revert due to gas limits, and the catch block will be executed thanks to the saved gas.

The following test reproduces the issue. We set up the liquidity and fees, and mock the call to increaseLiquidity() to make it revert. The fees will never reach the FeeSplitter.sol and will be stuck in Exit10.sol.

Note: the following test requires a newer version of the Forge Standard Library in order to use vm.mockCallRevert(). It can be installed by executing forge install foundry-rs/forge-std --no-commit.

function test_Exit10_claimAndDistributeFees_LossOfFeesIfIncreaseLiquidityReverts() public {

// Generate liquidity and fees

_bootstrapLock(10_000e6, 1 ether);

_skipBootstrap();

_createBond(100_000e6, 10 ether);

_generateFees(address(token0), address(token1), 1000e6);

// Assume call to nonfungiblePositionManager.increaseLiquidity reverts

vm.mockCallRevert(

nonfungiblePositionManager,

abi.encodeWithSelector(INPM.increaseLiquidity.selector),

""

);

// Call function

exit10.claimAndDistributeFees();

// FeeSplitter is empty

uint256 feesClaimed0 = token0.balanceOf(feeSplitter);

uint256 feesClaimed1 = token1.balanceOf(feeSplitter);

assertEq(feesClaimed0, 0);

assertEq(feesClaimed1, 0);

// Fees are stuck in exit10 contract

assertGt(token0.balanceOf(address(exit10)), 0);

assertGt(token1.balanceOf(address(exit10)), 0);

}

In this other test we demonstrate the griefing scenario. Even if the call to increaseLiquidity() would succeed, a bad actor can arbitrarily exercise the issue by choosing a gas limit such that the call reverts due out of gas. The entire call to claimAndDistributeFees takes about ~360k units of gas, before calling increaseLiquidity() the gas cost is a bit more than 150k and the call to increaseLiquidity() itself takes a bit more than 50k gas. By choosing 200k units of gas we can get to point of calling increaseLiquidity(), but make this call fail due to out of gas since the forwarded gas will be less than 50k.

function test_Exit10_claimAndDistributeFees_IntentionalRevert() public {

// Generate liquidity and fees

_bootstrapLock(10_000e6, 1 ether);

_skipBootstrap();

_createBond(100_000e6, 10 ether);

_generateFees(address(token0), address(token1), 1000e6);

// Call function and supply a gas limit such that the call to "increaseLiquidity()" reverts due to OOG.

// The function still continues execution since EIP150 will save 1/64 of available gas, enough to

// execute the return in the catch clause.

exit10.claimAndDistributeFees{gas: 200_000}();

// FeeSplitter is empty

uint256 feesClaimed0 = token0.balanceOf(feeSplitter);

uint256 feesClaimed1 = token1.balanceOf(feeSplitter);

assertEq(feesClaimed0, 0);

assertEq(feesClaimed1, 0);

// Fees are stuck in exit10 contract

assertGt(token0.balanceOf(address(exit10)), 0);

assertGt(token1.balanceOf(address(exit10)), 0);

}

Impact

High. The collected fees will be lost in the contract. Normally, this would only happen if the call to increaseLiquidity() reverts. However, a bad actor can arbitrarily trigger the issue just by choosing the gas limit.

Recommendation

Use a two-step process to claim and re-invest bootstrap fees.

1) Store the fees earned by bootstrappers in some intermediate variables in collectFees()

bootstrapFees0 += (bootstrapBucket * amountCollected0) / _liquidityAmount();

bootstrapFees1 += (bootstrapBucket * amountCollected1) / _liquidityAmount();

2) Use another function to reinvest the fees into the Uniswap pool. Merely allowing the function continue execution in the catch clause is not enough, as that would incentivize attackers to intentionally trigger the issue to steal funds away from the bootstrap reserve.

function investBoostrapFees(AddLiquidity memory params) public {

require(params.amount0Desired == boostrapFees0, "Invalid amount0Desired");

require(params.amount1Desired == boostrapFees1, "Invalid amount1Desired");

(, , uint256 amountAdded0, uint256 amountAdded1) = _addLiquidity(params);

boostrapFees0 -= amountAdded0;

boostrapFees1 -= amountAdded1;

}

We can adopt a similar approach as the MasterChef contract and reinvest liquidity whenever we withdraw from the MasterchefExit. As the rewards from the bootstrap reserve are directed towards the EXIT bucket, EXIT token holders are incentivized to reinvest their funds.

function withdraw(uint256 pid, uint256 amount,AddLiquidity memory params) external {

withdraw(pid, amount);

Exit10(owner()).investBoostrapFees(params);

}

Developer Response

Fixed in commit 71527c5ec2b1f186fd348bada65e0fd78ceb9bd9

Medium Findings

1. Medium - Using tick as price proxy is slightly inaccurate

The goal of Exit10 is to run the protocol until the price of ETH is $10k or greater, at which point Exit10.exit10() is called and the liquidity is withdrawn from Uniswap to distribute to users. In contrast to the stated goals, _requireOutOfTickRange() relies on the Uniswap pool tick and not the price provided by the pool. Because the ticks are located at discrete intervals, they are less precise than using the price value from the Uniswap TWAP. This can result in ETH reaching a price of $10k but the protocol won’t enter exit state and withdrawals will still not be possible.

Technical Details

_requireOutOfTickRange() is the key function that determines whether the price of ETH has reached a price above $10k and whether the Exit10 protocol’s mission is complete. This function works by checking the WETH/USDC tick value and determining whether it is in the tick range or not.

The tick values set in the environment variables are LOWER_TICK=184210 and UPPER_TICK=214170. We can do some math to check what ETH prices this corresponds to.

// Step 1. calculate 1.0001^tickValue

// Step 2. multiply by 10^-12 because of the USDC/WETH decimals conversion

// Step 3. invert the value because of the order of WETH and USDC addresses

1 / ((1.0001**184210) * (10 ** -12)) = 10006.019136330182

1 / ((1.0001**214170) * (10 ** -12)) = 500.24195658614434

The chosen tick value that is used for the lower tick corresponds to a price of roughly $10006, which means that if the price of ETH only reaches $10005 before dropping below $10k, the exit10() function cannot be called. A tick value of 184216 or relying on slot0.sqrtPriceX96 instead of slot0.tick would be more precise, but using one of these values would then break the stated goal of holding only USDC when ETH arrives ta $10k because liquidity can only be removed at ticket intervals of 10 ticks. In summary, the protocol has 2 conflicting goals that are slightly mismatched: triggering exit10() when the price of ETH rises above $10k and holding only USDC at the same time that exit10() is called.

One possible improvement for price data that would also protect against the situation of a USDC depeg event causing the price of ETH to appear to rise above $10k is to use Chainlink or another decentralized oracle solution for price data. Even if Chainlink is not the primary source of price data, it would be a useful secondary data source to validate that the Uniswap TWAP price is correct and that the price of ETH has indeed reached above 10k to allow exit10() to be called.

Impact

Medium. Using tick values as a proxy for the price is less precise than using the Uniswap TWAP price data directly and can result in the protocol not functioning as designed.

Recommendation

Clarify the protocol goals and the accuracy of achieving those goals in the docs. While Exit10006 might not be a catchy name, such clarification would be useful to include in the docs.

Developer Response

Acknowledged, the contract will stay as is because the protocol requires all liquidity to be USDC in the pool once ETH reaches 10K.

2. Medium - Incorrect EXIT_DISCOUNT values

The .env environment file sets the EXIT_DISCOUNT value to 5, which when combined with the PERCENT_BASE constant value of 10_000, results in a 0.05% discount on EXIT tokens. This contradicts the documentation which states that the discount is 5%.

Technical Details

The docs page describing the EXIT token describes a 5% discount on the EXIT token. But this value is not used consistently in the code.

The value set in the .env file combined with the constant PERCENT_BASE value results in a much lower discount, only 0.05%.

Impact

Medium. The exit discount in the code does not match the docs.

Recommendation

Revise the documentation and the .env file so that the EXIT token discount implementation is consistent with the documentation.

Developer Response

Fixed in commit f15093751c1238b5c42f1351cb74b747d1329344

3. Medium - Problematic MasterchefExit rewards distribution to first EXIT staker

MasterChefExit.sol has a deposit() function for users to deposit their reward tokens. This function has issue that could lead to a MEV competition between users resulting in some users losing out on rewards.

Technical Details

There are three problems with MasterchefExit.deposit():

- Only the first staker to call

deposit()receives rewards, which can lead to frontrunning of this function. - A zero amount is permitted in

deposit(), meaning the caller does not need to have any tokens. - Because a zero amount is permitted in

deposit(),pool.totalStakedwill not increase afterdeposit()is called the first time with a zero amount, sodeposit()can keep getting called with a zero amount by anyone until there is a non-zero value staked.

Impact

Medium. There is a risk of frontrunning and the logic allows a zero amount.

Recommendation

Add a check to revert deposit() when it is called with a zero amount value.

Developer Response

Fixed in commit 0a05a38e2e049aedf1f6bcea1454bd934a46989f

4. Medium - Griefer can force bootstrap depositors to lose all funds if exit10() is triggered during the bootstrap phase

Technical Details

Within the bootstrapLock(..) function in the Exit10 contract, there is no check which prevents a user from calling it even after the exit10() function has been called and inExitMode has been set to true. The call to exit10() will set bootstrapBucketFinal to the current bootstrap funds - however an attacker is still able to call bootstrapLock(..), thus increasing the actual size of the bootstrap bucket to be greater than bootstrapBucketFinal.

If the attacker deposits an amount equal to bootstrapBucketFinal, they will be able to trap all existing bootstrapper’s deposits in the contract. To do so, they first call bootstrapLock(..) with this amount, and then call bootstrapClaim(). This function will call _safeTokenClaim() which has the following check which only allows an amount up to bootstrapBucketFinal to be claimed: _claim = (_claimed + _claim <= _supply) ? _claim : _supply - _claimed;. Thus, the attacker will be able to withdraw their own funds, leaving normal bootstrap depositors locked out of claiming.

Impact

Medium. Griefer can force bootstrap depositors to lose all funds if exit10() is triggered during the bootstrap phase.

Recommendation

Add the following check at the start of the bootstrapLock(..) function in the Exit10 contract: _requireNoExitMode();

After this change is made, most likely the line bootstrapBucket = 0 can be removed from exit10() for minor gas savings. Another option is to remove bootstrapBucketFinal entirely and replace it with bootstrapBucket.

Developer Response

Fixed in commit 4f0450f7727ec08c09bdfb57d45444793b683bc8

5. Medium - Updating fees with zero amount can be used to dilute rewards

The updateFees() function can be called with a zero amount to extend the reward period in Masterchef.sol without adding any reward.

Technical Details

The updateFees() function present in FeeSplitter.sol is used to swap fees to ETH and feed those as rewards in Masterchef.sol. Doing so recalculates the reward rate to include the new amounts and extends the reward period by the configured rewards duration.

This function can be abused by a malicious actor to dilute the reward process by calling it with a zero amount. This action won’t increase the amount of rewards, but will extend the reward period, effectively lowering the reward rate. Current stakers will need to wait an additional period to claim their rewards.

In this test, the issue is triggered each day using a reward duration of 10 days, and produces the following log:

Logs:

``` Logs: MC0 RewardRate: 599161603689814814814814814 MC0 PeriodFinish: 1684365053 MC1 RewardRate: 1048532902071511243386243386 MC1 PeriodFinish: 1684365053 ============================================= MC0 RewardRate: 556364346283399470899470898 MC0 PeriodFinish: 1684451453 MC1 RewardRate: 973637694780689011715797429 MC1 PeriodFinish: 1684451453 ============================================= MC0 RewardRate: 516624035834585222978080119 MC0 PeriodFinish: 1684537853 MC1 RewardRate: 904092145153496939450383326 MC1 PeriodFinish: 1684537853 ============================================= MC0 RewardRate: 479722318989257707051074396 MC0 PeriodFinish: 1684624253 MC1 RewardRate: 839514134785390015203927374 MC1 PeriodFinish: 1684624253 ============================================= MC0 RewardRate: 445456439061453585118854796 MC0 PeriodFinish: 1684710653 MC1 RewardRate: 779548839443576442689361133 MC1 PeriodFinish: 1684710653 ============================================= MC0 RewardRate: 413638121985635471896079453 MC0 PeriodFinish: 1684797053 MC1 RewardRate: 723866779483320982497263909 MC1 PeriodFinish: 1684797053 ============================================= MC0 RewardRate: 384092541843804366760645206 MC0 PeriodFinish: 1684883453 MC1 RewardRate: 672162009520226626604602201 MC1 PeriodFinish: 1684883453 ============================================= MC0 RewardRate: 356657360283532626277741977 MC0 PeriodFinish: 1684969853 MC1 RewardRate: 624150437411639010418559186 MC1 PeriodFinish: 1684969853 ============================================= MC0 RewardRate: 331181834548994581543617550 MC0 PeriodFinish: 1685056253 MC1 RewardRate: 579568263310807652531519244 MC1 PeriodFinish: 1685056253 ============================================= MC0 RewardRate: 307525989224066397147644867 MC0 PeriodFinish: 1685142653 MC1 RewardRate: 538170530217178534493553583 MC1 PeriodFinish: 1685142653 ============================================= MC0 RewardRate: 285559847136633083065670233 MC0 PeriodFinish: 1685229053 MC1 RewardRate: 499729778058808639172585469 MC1 PeriodFinish: 1685229053 ============================================= ```Impact

Medium. Technically, stakers won’t lose their rewards but a griefer can extend the period indefinitely to dilute the reward process.

Recommendation

Avoid calling updateRewards() in Masterchef.sol if the amounts are zero or are below a certain threshold, so that only meaningful amounts extend the reward period.

Developer Response

Fixed in commit 68e6cc9303c104bcceb4deeb168877292ec0c925

6. Medium - Pool spot price manipulation allows to call exit10() before ETH reaches 10K

If a flash loan of sufficient size can be taken, it is possible to manipulate the spot price of the ETH/USDC 500 pool to beyond 10k USDC and trigger the exit10() function at will. This concerns in particular the chains where the ETH/USDC 500 pool liquidity is not very deep (e.g. Optimism).

Technical Details

In Exit10.exit10() it is checked inside _requireOutOfTickRange() whether the price of ETH has surpassed 10k by comparing the current tick to the upper or lower tick of the position range.

function _requireOutOfTickRange() internal view {

if (TOKEN_IN > TOKEN_OUT) {

require(_currentTick() <= TICK_LOWER, 'EXIT10: Current Tick not below TICK_LOWER');

} else {

require(_currentTick() >= TICK_UPPER, 'EXIT10: Current Tick not above TICK_UPPER');

}

}

_currentTick() is taken from slotO()

function _currentTick() internal view returns (int24 _tick) {

(, _tick, , , , , ) = POOL.slot0();

}

The tick value returned by slotO() is the current tick and moves as the liquidity inside the pool is used up during swaps.

If the USDC cumulated liquidity from the current price up to 10k is less than what can be obtained with a flash loan, then it is possible to take a flashloan and make a swap which will push the price beyond 10k.

At this moment on Optimism there is:

- 3.24M of USDC liquidity on UniV3 WETH/USDC 500 pool

- 8M USDC available to borrow on AaveV3

The following PoC shows how a 4M USDC to ETH swap will manipulate the current tick to more than -184210 (corresponds to 10k on Optimism).

function testManipulate() public {

console2.log("block number:", block.number);

(uint160 sqrtPriceX96Init, int24 tickInit, , , , , ) = pool.slot0();

// Take USDC from a large holder instead of flashloan for simplicity

address atck = address(0xEbe80f029b1c02862B9E8a70a7e5317C06F62Cae);

uint value = 4_000_000 * 1e6;

vm.startPrank(atck);

IERC20(pool.token1()).approve(address(router), value);

ISwapRouter.ExactInputSingleParams memory params = ISwapRouter.ExactInputSingleParams(

pool.token1(), // USDC

pool.token0(), // WETH

500,

atck,

block.timestamp,

value,

0,

0

);

router.exactInputSingle(params);

vm.stopPrank();

(uint160 sqrtPriceX96Fin, int24 tickFin, , , , , ) = pool.slot0();

console2.log("tickInit:", tickInit);

console2.log("tickFin:", tickFin);

}

which outputs:

Logs:

block number: 95682224

tickInit: -201109

tickFin: -102138

Full PoC file here: https://gist.github.com/bahurum/9daac43a30cd67fe02453a58a52645b5

At any time, an attacker can take a flashloan, swap USDC to ETH, trigger exit10() and swap ETH back to USDC on the pool. Note that this may not yield any profit for the attacker (who would have to pay at least for flash loan fees), but the result is that the protocol ends sooner than expected.

Impact

Medium. Attacker can trigger exit10() sooner than expected at some cost. This will skip all the phases of the protocol and end the protocol.

Recommendation

In _requireOutOfTickRange(), consider checking that the current tick is not too far from the tick at the beginning of the block. This will make exit10() revert if the price has been manipulated prior to calling it.

function _requireOutOfTickRange() internal view {

+ int24 blockStartTick = OracleLibrary.getBlockStartingTickAndLiquidity(POOL);

+ int24 currentTick = _currentTick();

if (TOKEN_IN > TOKEN_OUT) {

- require(_currentTick() <= TICK_LOWER, 'EXIT10: Current Tick not below TICK_LOWER');

+ require(currentTick <= TICK_LOWER, 'EXIT10: Current Tick not below TICK_LOWER');

} else {

- require(_currentTick() >= TICK_UPPER, 'EXIT10: Current Tick not above TICK_UPPER');

+ require(currentTick >= TICK_UPPER, 'EXIT10: Current Tick not above TICK_UPPER');

}

+ int24 tickDiff = blockStartTick > currentTick ? blockStartTick - currentTick : currentTick - blockStartTick;

+ require(tickDiff < 100); // 100 ticks is about 1% in price difference

}

Developer Response

Fixed in commit f6978737682f202a7443f6c76ef22461bdcfad73

Low Findings

1. Low - Use _collect() return values

When Exit10.sol calls _collect(), it ignores the return values in all cases except one. Instead, the return values should be favored for later accounting purposes over the input arguments amountRemoved0 and amountRemoved1 that are provided to _collect().

Technical Details

_decreaseLiquidity() is called before each _collect() call (except one) to return the amount of each token that is passed to _collect(). However, after _collect() is called, it is assumed that the values passed as arguments to _collect() are equivalent to the values that are returned by _collect(). Looking at the Uniswap v3 NatSpec for the underlying NonfungiblePositionManager.collect(), the arguments are described as indicating the maximum amount of tokens to collect, and the return values from collect() indicate the actual value that is returned by the function.

One example of this assumption is in bootstrapLock(). amountRemoved0 and amountRemoved1 are passed to _collect() as arguments and then are subtracted from amountAdded0 and amountAdded1. But because the arguments passed to _collect() are the maximum values that could be collected, the return values from _collect() should be what is subtracted from amountAdded0 and amountAdded1.

Impact

Low. If the assumption that maxAmount passed to _collect() is always the same from the return values of _collect() is ever broken in any edge case, the math in Exit10 will be inaccurate.

Recommendation

Rely on the return values from _collect() for internal accounting after _collect() is called.

Developer Response

Fixed in commit ade41fe76eeddd23864811e84120d6ff4a0c5958

2. Low - No emergency function(s) to handle edge cases

There are no emergency functions to handle unexpected edge cases. Such edge cases include ETH not reaching 10k before the protocol deadline or Uniswap activating the fee switch.

Technical Details

The Exit10 protocol is designed to be immutable, with renounceOwnership() calls in NFT.sol and FeeSplitter.sol. This immutability and the lack of emergency functions could result in locked funds due to uncontrollable external events. The funds that are locked until Exit10.exit10() is called include bootstrap funds, STO, and EXIT, which can only be withdrawn with bootstrapClaim(), stoClaim(), exitClaim().

Uniswap fees are currently passed on to liquidity providers. The Uniswap DAO has long discussed the idea of turning on the fee switch in order to direct some of these fees to Uniswap token holders. This change could substantially impact the fees earned by liquidity providers and may therefore change the assumptions in the Exit10 protocol. A similar result could happen if other events, such as a Uniswap hack or a better AMM, causes the ETH-USDC pool to generate substantially lower fees than estimated. Regardless of what actually happens, the assumption that the underlying Uniswap LP positions will generate fees when held in Exit10 depends on external factors not under control of the protocol. If these assumptions change, it may be useful to allow for emergency withdrawal of funds even before ETH reaches 10k.

Another edge case that may occur is if ETH never reaches 10k. While this is a very pessimistic case, external factors like new laws banning certain cryptocurrencies, hacks, hard forks, or other factors could impact the price of ETH and when it might reach 10k. If the price of ETH does not reach 10k before the hardcoded deadline timestamp, which is in the year 2286, the funds will be locked.

Another edge case is if a USDC depeg event happens. This could cause the price of ETH in the Uniswap pool to appear to rise above 10k, but in actuality the price of ETH may only be at a lower value such as $8000.

A final edge case is that one of the Uniswap contracts behind a proxy, such as the Uniswap v3 Router, may undergo a change that is not backwards compatible. While this is unlikely to happen, a security vulnerability or unexpected DAO vote could cause this to happen.

Impact

Low. Unexpected edge cases can cause the protocol to have locked funds or reduced profits.

Recommendation

Consider mitigation strategies to avoid locked funds. This can include adding an emergency function or allowing the owner to override the call to exit10() even if the price point is not realized.

Developer Response

Acknowledged. This is a protocol risk and it is mentioned in the documentation.

3. Low - Inelegant rounding solution

The logic in _safeTokenClaim() implements a hacky solution to rounding imprecision. Unlike the ERC4626 standard which specifies when rounding up and rounding down should happen when converting between assets and shares for more consistent handling of all user interactions, the conversion between assets and rewards in _safeTokenClaim() could penalize late reward withdrawals.

Technical Details

The purpose of _safeTokenClaim() is to burn all tokens held by a user and to return the quantity of rewards the user can claim. The calculation of claimable rewards due to the user is a 2-step process.

In the first step, the user’s claimable rewards is calculated as the fraction of final totalSupply that msg.sender owns. This calculation is similar to how ERC4626 asset <-> share conversion happens in functions such as convertToShares() and convertToAssets(). The second step is to modify the value of the user’s claimable rewards if the total claimed rewards (including the amount that is claimed in the active transaction) exceeds the total supply of rewards that exist. The fact that this second step exists implies that the protocol could encounter a situation where the outstanding rewards exceed the rewards that the protocol can afford to payout, which means that at least one user owed rewards will not receive their full amount of rewards. The way the logic works could lead to a bank run scenario, where user(s) who are late to redeem their rewards don’t receive the full value of their rewards.

While it is not clear under what circumstance this line of logic would be needed, a better design is one like ERC4626 that manages the rounding up or down appropriately and never reaches a bank run type scenario where some users do not receive the expected amount of value due to rounding error accumulation.

Impact

Low. The exact scenario where rounding errors could be problematic is unclear, but the currently implemented solution is not ideal.

Recommendation

First determine whether this line of logic is needed, and then determine an improved solution that rounds up or down accordingly. Most likely the logic can be borrowed from ERC4626 redeem(), where shares (equivalent to reward tokens) are redeemed for underlying (USDC).

Developer Response

Same issue as H2 Fixed in commit afc424cbe293201f4665e6c05e11c81359b7aa71

4. Low - Incentive tokens EXIT, BOOT exposed to frontrunning

There is a capped supply of EXIT and BOOT tokens that are provided to early liquidity providers as additional incentives to deposit into Exit10 early. When the protocol is nearing or already at the capped supply of these incentive tokens, frontrunning can cause users to receive fewer incentive tokens than they were expecting to receive.

Technical Details

There is a limited supply of EXIT tokens. If a user converts a bond with convertBond() and _mintExitCapped() is called when mintAmount evaluates to zero or when the amount of EXIT to be minted updates to MAX_EXIT_SUPPLY - EXIT.totalSupply() instead of the original amount input argument, then the user may end up receiving less EXIT tokens than they expected (with a worst case of receiving zero EXIT). The process of increasing EXIT.totalSupply() to the MAX_EXIT_SUPPLY is at risk of being frontrun if a user is converting a bond in the same block as another user.

The same frontrun risk exists with BOOT tokens in bootstrapLock(). Once bootstrapBucket increases to the value of BOOTSTRAP_CAP or near this value, a user calling bootstrapLock() may receive less BOOT tokens than expected (with a worst case of receiving zero BOOT). This means that user calls to bootstrapLock() (and also calls to swapAndBootstrapLock()) could be frontrun with the user receiving less BOOT than expected. The risk of frontrunning bootstrapLock() to claim BOOT is greater than the risk of frontrunning convertBond() to claim EXIT, because only users with existing bonds can call convertBond().

Impact

Low. Normal users may get frontrun and lose out on these extra incentives but they will not lose any value from the tokens they choose to invest in the protocol. But because the user never actually owned these incentive tokens in the first place, there is technically no theft of rewards.

Recommendation

Consider recommending users to use MEV protection solution like CowSwap or MEV Blocker if they are concerned about the risk of receiving fewer incentive tokens than expected.

Developer Response

Acknowledged. Will add to the documentation.

5. Low - Incorrect PROTOCOL_GUILD address for multichain deployment

PROTOCOL_GUILD in Exit10.sol is a constant that is hardcoded to 0xF29Ff96aaEa6C9A1fBa851f74737f3c069d4f1a9. This is the proper address for Ethereum mainnet, but the Protocol Guild does not receive donations at this address on other chains. Exit10 will be deployed to Optimism and Arbitrum, where funds sent to this address will be locked unless the Protocol Guild changes their donation approach in the future.

Technical Details

PROTOCOL_GUILD is hardcoded to 0xF29Ff96aaEa6C9A1fBa851f74737f3c069d4f1a9 in this line. But checking the Optimism blockchain scanner and Arbitrum blockchain scanner shows there is no contract deployed to these addresses. Any funds sent to this address on chains other than mainnet will not be useful to the Protocol Guild. The Protocol Guild only takes donations on Ethereum mainnet.

Impact

Low. Donated funds will be locked. These funds did not belong to the users in the first place so it is only the donation funds that are impacted.

Recommendation

Change PROTOCOL_GUILD from a constant address to an immutable address that is set in the constructor on deployment. Identify a different address to donate funds to for Optimism and Arbitrum deployments.

Developer Response

Fixed in commit d16600dfcee4755d98942e488c94da701119e444

6. Low - High hardcoded slippage

FeeSplitter.sol has a constant slippage of 1%. This is a high slippage for a deep liquidity pool like USDC/ETH and could be prone to sandwich attacks.

Technical Details

The slippage can be changed to a lower value. It won’t cause the protocol to become stuck because FeeSplitter.sol uses function updateFees(uint256 swapAmountOut) to swap which has an input parameter. If the liquidity gets too low, and defined slippage is too high, input swapAmountOut can be decreased to complete the swaps.

Impact

Low. Too high slippage can result in users receiving less value than expected.

Recommendation

Set slippage to lower value.

Developer Response

Fixed in commit 796c2143a2e43cd7613989e73f497ad52f7fccae

7. Low - Bootstrap rewards are shared

Early bootstrappers generate fees for the protocol that are shared across all bootstrappers.

Technical Details

When a user locks in an amount for bootstrapping, they transfer in USDC and WETH in order to add liquidity to the pool. BOOT tokens are then minted to the user 1:1 for the amount of liquidity they were able to add to the pool. Regardless of when a user locks into bootstrapping, they are minted the same ratio of BOOT as the original entrants.

After the protocol has performed an Exit10 and a user goes to claim their BOOT, they are given USDC based on the ratio of the BOOT they own to the size of the bootstrap bucket. This means that fees generated during the bootstrap period are distributed to all bootstrappers, penalizing the early bootstrappers.

Impact

Low. Early bootstrappers are sharing fees they generate for the protocol with later bootstrappers. The impact is lowered due to the shortened time frame and upper capacity limits enforced during bootstrapping.

Recommendation

Consider incorporating the fees generated up until that time when calculating the number of BOOT to mint to newer bootstrappers.

Developer Response

Acknowledged. Will add to the documentation.

8. Low - Possible loss of funds with price limited swaps through DepositHelper

In DepositHelper, if a user calls swapAndBootstrapLock() and swapAndCreateBond() with sqrtPriceLimitX96 != 0, the part of amountIn that is not swapped is not used for minting liquidity and is left in the contract.

Technical Details

In DepositHelper._depositAndSwap() a user can provide TOKEN_IN and TOKEN_OUT at a certain ratio and make the contract perform a swap with _swapParams in order to provide liquidity at a different ratio. Let’s say that _swapParams.tokenIn == TOKEN_0. The issue is that the contract assumes that _swapParams.amountIn is fully used for the swap and computes the amount to provide as liquidity as _initialAmount0 - _swapParams.amountIn (DepositHelper.sol#L85-L91).

if (_swapParams.tokenIn == TOKEN_0) {

_initialAmount0 -= _swapParams.amountIn;

_initialAmount1 += amountOut;

} else {

_initialAmount1 -= _swapParams.amountIn;

_initialAmount0 += amountOut;

}

Here is a PoC that demonstrates the issue:

function testPriceLimitSwaps() public {

_skipBootstrap();

uint160 sqrtRatioAX96 = TickMath.getSqrtRatioAtTick(tickLower);

uint160 sqrtRatioBX96 = TickMath.getSqrtRatioAtTick(tickUpper);

(uint160 sqrtRatioX96, int24 tick, , , , , ) = IUniswapV3Pool(vm.envAddress('POOL')).slot0();

console.log("initial USDC balance of DepositHelper:", ERC20(usdc).balanceOf(address(depositHelper)));

console.log("sqrtRatioX96:", sqrtRatioX96);

(uint256 amount0, uint256 amount1) = LiquidityAmounts.getAmountsForLiquidity(

sqrtRatioX96, sqrtRatioAX96, sqrtRatioBX96, 1e15); // amounts to obtain 1e15 liquidity

uint256 swapAmount0 = convert1ToToken0(sqrtRatioX96, amount1, 6); // usdc amount to swap

ERC20(usdc).transfer(alice, amount0 + swapAmount0); // give usdc to alice

IUniswapV3Router.ExactInputSingleParams memory swapParams = _getSwapParams(

usdc, weth, swapAmount0);

swapParams.sqrtPriceLimitX96 = TickMath.getSqrtRatioAtTick(tick - 1);

console.log("alice sends", amount0 + swapAmount0, "USDC");

console.log("and swaps", swapAmount0, "USDC for ETH");

console.log("swapParams.sqrtPriceLimitX96 set to:", swapParams.sqrtPriceLimitX96);

vm.startPrank(alice);

ERC20(usdc).approve(address(depositHelper), amount0 + swapAmount0);

depositHelper.swapAndCreateBond(amount0 + swapAmount0, 0, swapParams);

vm.stopPrank();

uint256 usdcLeft = ERC20(usdc).balanceOf(address(depositHelper));

console.log("Only", swapAmount0 - usdcLeft, "USDC has been swapped and used to mint bonds");

console.log("USDC Left into DepositHelper:", usdcLeft);

}

which outputs:

Logs:

initial USDC balance of DepositHelper: 0

sqrtRatioX96: 1980704062856608439838598758400000

alice sends 41638723701 USDC

and swaps 24004813136 USDC for ETH

swapParams.sqrtPriceLimitX96: 1980530912134207514651007739210316

Only 5701654427 USDC has been swapped and used to mint bonds

USDC Left into DepositHelper: 18303158709

Full PoC file here: https://gist.github.com/bahurum/96a5a6c2082b81712392924cd2e673fd.

Impact

Low. Part of the swap amount can be lost when swapAndBootstrapLock() and swapAndCreateBond() are called by a user specifying a price limit for the swap.

Recommendation

When calculating the amounts for providing liquidity, account for the amount of _swapParams.tokenIn left into the contract after the swap:

if (_swapParams.tokenIn == TOKEN_0) {

- _initialAmount0 -= _swapParams.amountIn;

+ _initialAmount0 = IERC20(TOKEN_0).balanceOf(address(this));

_initialAmount1 += amountOut;

} else {

- _initialAmount1 -= _swapParams.amountIn;

+ _initialAmount1 = IERC20(TOKEN_1).balanceOf(address(this));

_initialAmount0 += amountOut;

}

Developer Response

Fixed in commit 87257c08584ca001d72b672914bf7b2c4a654b66

Gas Savings Findings

1. Gas - Relying on hardcoded values can save gas

Some logic that relies on unchanging immutable variables can be simplified for gas savings.

Technical Details

The variables TOKEN_IN and POOL are immutable in Exit10.sol. In UniswapV3Pool.sol the variables token1 and token0 are immutable. Because these values are not changing, branching logic like this if statement can be removed and simplified because the same logic path will always be followed because immutable variables cannot change after deployment. The same applies to places where POOL.token0() is used, it can be replaced with TOKEN_IN or TOKEN_OUT to remove an external call.

Impact

Gas savings.

Recommendation

Simplify code for gas savings by hardcoding logic based on immutable values. Be aware that the hardcoded logic would differ depending on the chain that Exit10 is deployed on.

2. Gas - Unnecessary 1e18 decimals multiplication

Reducing the decimals of bondDuration and ACCRUAL_PARAMETER in _getAccruedLiquidity() could save gas when it is called by convertBond() by removing a multiplication operation.

Technical Details

_getAccruedLiquidity() multiplies 1e18 by the value of block.timestamp - _params.startTime so that the resulting bondDuration variable has decimals of 1e18. But this is unnecessary because in the next line of code, the presence of bondDuration in the numerator and denominator means these decimals will cancel each other out. The code can be simplified and one multiplication operation removed by keeping the original decimals that block.timestamp has.

Impact

Gas savings.

Recommendation

Remove unnecessary 1e18 decimals on timestamp-related values. This involves changing the value that the immutable ACCRUAL_PARAMETER is set to and editing _getAccruedLiquidity() by removing the 1e18 multiplication.

- ACCRUAL_PARAMETER = params_.accrualParameter * DECIMAL_PRECISION;

+ ACCRUAL_PARAMETER = params_.accrualParameter;

- uint256 bondDuration = 1e18 * (block.timestamp - _params.startTime);

+ uint256 bondDuration = block.timestamp - _params.startTime;

accruedAmount = (_params.bondAmount * bondDuration) / (bondDuration + ACCRUAL_PARAMETER);

3. Gas - Pass _liquidityAmount() to collectFees() for 2nd argument

The only use case for the remainingBuckets parameter in FeeSplitter.collectFees() is the sum this value with pendingBucket. This summation rederives the value of _liquidityAmount() but in a less efficient way.

Technical Details

The only place where the remainingBuckets argument is used in on lines of code like pendingBucket + remainingBuckets. This summation should return the same value as Exit10._liquidityAmount(), so pass _liquidityAmount() instead of bootstrapBucket + reserveBucket + _exitBucket() as the 2nd parameter to FeeSplitter.collectFees() to save gas. Even better, cache _liquidityAmount() instead of calling the internal function multiple times.

Impact

Gas savings.

Recommendation

Make this change in Exit10.claimAndDistributeFees() or cache _liquidityAmount() to a local variable at the start of the function:

FeeSplitter(FEE_SPLITTER).collectFees(

pendingBucket,

- bootstrapBucket + reserveBucket + _exitBucket(),

+ _liquidityAmount(),

amountCollected0,

amountCollected1

);

And then make this change in FeeSplitter.collectFees() (and consider renaming the 2nd parameter from remainingBuckets to totalLiquidityAmount).

uint256 portionOfPendingBucketTokenIn = _calcPortionOfValue(

pendingBucket,

- pendingBucket + remainingBuckets,

+ remainingBuckets,

amountTokenIn

);

uint256 portionOfPendingBucketTokenOut = _calcPortionOfValue(

pendingBucket,

- pendingBucket + remainingBuckets,

+ remainingBuckets,

amountTokenOut

);

4. Gas - Remove function used only once

Some function are used only once and can be removed to save gas without sacrificing readability.

Technical Details

Functions _getDiscountedExitAmount() and _getLiquidityForBootsrapTarget() are used only once. They can be removed and their code can be inlined to the only place where they are used. This will save gas without sacrificing readability if the variable naming is in line. The same is true of _transferAmountIn() in AMasterchefBase, it is only used in deposit().

Impact

Gas savings.

Recommendation

Remove functions _getDiscountedExitAmount() and _getLiquidityForBootsrapTarget() and inline their code to the only place where they are used.

5. Gas - Remove unused variables

Some state variables are not used and can be removed to save gas.

Technical Details

State variable FACTORY is defined and used only in constructor() and can be removed.

State variable bootstrapDeposit is not used at all and can be removed.

Impact

Gas savings.

Recommendation

Remove unused variables.

6. Gas - Remove unneeded variable

State variable DEPLOYMENT_TIMESTAMP can be removed without loss of any data or functionality.

Technical Details

There is no need to store deployment timestamp because this information can be retrieved from deployed block. This value is not used in any function and can be removed.

Small change is required in Exit10.sol.

- DEPLOYMENT_TIMESTAMP = block.timestamp;

- BOOTSTRAP_PERIOD = params_.bootstrapPeriod;

+ BOOTSTRAP_PERIOD = params_.bootstrapPeriod + block.timestamp;

Additional gas saving will be in dropping add operation at L554:

- return (block.timestamp < DEPLOYMENT_TIMESTAMP + BOOTSTRAP_PERIOD);

+ return (block.timestamp < BOOTSTRAP_PERIOD);

Impact

Gas savings.

Recommendation

Remove unneeded state variable DEPLOYMENT_TIMESTAMP.

7. Gas - Struct packing

The struct PoolInfo could benefit from struct packing to place multiple elements into a single slot.

Technical Details

The allocPoint and lastUpdateTime elements are currently uint256, however, allocPoint appears unlikely to exceed 100 and lastUpdateTime is only required to be as large as necessary to hold updated block.timestamp values. Given this, it may be reasonable to combine these two with the token address in order to have all three occupy only a single slot in storage.

Impact

Gas savings.

Recommendation

One example configuration may be:

struct PoolInfo {

address token;

uint32 allocPoint;

uint64 lastUpdateTime;

uint256 totalStaked;

uint256 accRewardPerShare;

uint256 accUndistributedReward;

}

8. Gas - Skip double fetching of the same value

The function _updatePool(uint256 _pid) receives a parameter _pid which is used to fetch the same value from the storage. This can be avoided by passing the value directly to the function because basically all functions that call already fetch the value from the storage.

Technical Details

All functions that call _updatePool() already fetch the value from the storage, except _massUpdatePools() which can be easily changed to fetch the value from the storage. This will save gas on every call of _updatePool().

Impact

Gas savings.

Recommendation

Change function signature to use PoolInfo instead of _pid:

- function _updatePool(uint256 _pid) internal {

+ function _updatePool(PoolInfo storage pool) internal {

9. Gas - Use Shift Left instead of Multiplication if possible

A multiplication by any number x, which is a power of 2, can be calculated by shifting log2(x) to the left. MUL opcode uses 5 gas, while the SHL opcode uses 3 gas.

Technical Details

In the file FeeSplitter.sol:125:

-uint256 mc0TokenIn = (pendingBucketTokenIn * 4) / 10; // 40%

+uint256 mc0TokenIn = (pendingBucketTokenIn << 2) / 10; // 40%

In the file Exit10.sol:608:

-_stoRewards = tenPercent * 2;

+_stoRewards = tenPercent << 1;

Impact

Gas savings.

Recommendation

Use Shift Left instead of Multiplication when possible.

10. Gas - Cache state variables

State variable that are accessed multiple times can be cached in a local variable to save on gas.

Technical Details

In exitClaim() and stoClaim() the state variables EXIT and STO (respectively) are loaded three times, rather than being cached in a local variable.

Impact

Gas savings.

Recommendation

Amend the code as follows: Exit10.sol - https://github.com/open-bakery/exit10-protocol/blob/0b3c2782c5a93d2218234bc70fee31ec32f9e337/src/Exit10.sol#L372

function stoClaim() external returns (uint256 claim) {

BaseToken sto = STO;

uint256 stoBalance = IERC20(sto).balanceOf(msg.sender);

claim = _safeTokenClaim(

sto,

stoBalance,

STOToken(address(sto)).MAX_SUPPLY(),

teamPlusBackersRewards,

teamPlusBackersRewardsClaimed

);

// STO tokens are only for early backers and team

teamPlusBackersRewardsClaimed += claim;

_safeTransferToken(TOKEN_OUT, msg.sender, claim);

emit ClaimRewards(msg.sender, address(sto), stoBalance, claim);

}

Exit10.sol - https://github.com/open-bakery/exit10-protocol/blob/0b3c2782c5a93d2218234bc70fee31ec32f9e337/src/Exit10.sol#L389

function exitClaim() external returns (uint256 claim) {

BaseToken exit = EXIT;

uint256 exitBalance = IERC20(exit).balanceOf(msg.sender);

claim = _safeTokenClaim(exit, exitBalance, exitTokenSupplyFinal, exitTokenRewardsFinal, exitTokenRewardsClaimed);

exitTokenRewardsClaimed += claim;

_safeTransferToken(TOKEN_OUT, msg.sender, claim);

emit ClaimRewards(msg.sender, address(exit), exitBalance, claim);

}

The gas savings for the two changes above are as follow:

test_bootstrapClaim() (gas: -1 (-0.000%))

testScenario_3() (gas: -15 (-0.000%))

testScenario_0() (gas: -21 (-0.000%))

testFuzz_claims(uint256,uint256,uint256,uint256,uint256) (gas: -8 (-0.000%))

testScenario_1() (gas: -20 (-0.000%))

testScenario_2() (gas: -12 (-0.000%))

test_exitClaim() (gas: -8 (-0.000%))

test_stoClaim() (gas: -8 (-0.000%))

test_stoClaim_RevertIf_NotExited() (gas: 6 (0.001%))

test_exitClaim_RevertIf_NotExited() (gas: 6 (0.001%))

Overall gas change: -81 (-0.000%)

11. Gas - Redundant check in cancelBond()

cancelBond() does not need to perform a check on whether the param.liquidity parameter is equal to bond.bondAmount as long as it is then updated to use bond.bondAmount.

Technical Details

When a user cancels their bond, the amount of liquidity that they provided initially is removed from Uniswap, in order to pay them back. The _decreaseLiquidity() function requires a parameter of type RemoveLiquidity. In order to save gas, it is possible to remove the check _requireEqualValues and instead update the memory param parameter with bond.bondAmount.

#### Impact

This could lead to small gas savings:

test_cancelBond_withMoreBondsInTheSystem() (gas: -57 (-0.003%))

test_cancelBond_claimAndDistributeFees() (gas: -46 (-0.004%))

test_cancelBond() (gas: -46 (-0.006%))

test_cancelBond_RevertIf_StatusIsCanceled() (gas: -45 (-0.006%))

test_convertBond_RevertIf_StatusIsCanceled() (gas: -46 (-0.006%))

Overall gas change: -240 (-0.000%)

Recommendation

Update the code as follow to reduce gas usage for this function.

Exit.sol:cancelBond()

Line #243

- _requireEqualValues(bond.bondAmount, params.liquidity);

Line #249

+ params.liquidity = uint128(bond.bondAmount);

12. Gas - >= costs less gas than >.

There are 5 instances of this issue.

Technical Details

The compiler uses opcodes GT and ISZERO for solidity code that uses >, but only requires LT for >=, which saves 3 gas.

File: Exit10-code/exit10-protocol/src/AMasterchefBase.sol

215: if (_poolLastUpdateTime > periodFinish) return 0;

File: Exit10-code/exit10-protocol/src/Exit10.sol

177: if (bootstrapBucket > BOOTSTRAP_CAP) {

482: uint256 liquidityPerExit = actualLiquidityPerExit > projectedLiquidityPerExit

529: uint256 mintAmount = newSupply > MAX_EXIT_SUPPLY ? MAX_EXIT_SUPPLY - EXIT.totalSupply() : amount;

566: if (TOKEN_IN > TOKEN_OUT) {

Impact

Gas savings.

Recommendation

Use >= instead if appropriate.

Informational Findings

1. Informational - Standardize ProcessEth implementation

_processEth() is implemented in DepositHelper.sol and UniswapBase.sol. There are differences between the implementations:

- The DepositHelper implementation uses

elseinstead of a more strictelse if - The UniswapBase implementation is missing an event.

Technical Details

Compare the implementations of _processEth():

- DepositHelper implementation, without an event

- UniswapBase implementation, without an event

Impact

Informational.

Recommendation

Replace the else clause in the DepositHelper implementation with else if and add missing event to the UniswapBase implementation to keep the implementations identical.

2. Informational - Consider else if instead of else for stricter checks

There are several places where an else branch exists while an else if may increase the security assurances of the code.

Technical Details

Some else branches might be best changed to else if branches to ensure that no unexpected edge cases trigger the else case. For example:

- This

elsebranch could be replaced withelse if (POOL.token0() == TOKEN_IN) - This

elsebranch could be replaced withelse if (_swapParams.tokenIn == TOKEN_1)

Impact

Informational.

Recommendation

Add stricter checks instead of using else branches.

3. Informational - Possibly unnecessary event emit

An event emit in _mintExitCapped() may be unnecessary in some cases.

Technical Details

The MintExit event is emitted in _mintExitCapped(). This is the only event emitted in an internal function of Exit10.sol. It is emitted even when no EXIT token is minted. Instead, consider expanding the if statement to determine if EXIT is minted to include this emit. Another side effect of this emit is that it is duplicating the emit in ERC20._mint(), so each minting event will have 2 emits. Consider whether this is the intended result for minting EXIT tokens.

Impact

Informational.

Recommendation

Consider changing how this emit is triggered or removing it entirely.

4. Informational - Revert on zero case

There are several logic paths that skip certain logic in the case where amount == 0. Instead of allowing the code to execute in this case, revert instead to return gas back to the user and to avoid an attacker from reaching unexpected code paths.

Technical Details

Consider the implementation of _safeTransferToken():

function _safeTransferToken(address _token, address _recipient, uint256 _amount) internal {

if (_amount != 0) IERC20(_token).safeTransfer(_recipient, _amount);

}

If _amount is zero, _safeTransferToken() will not revert, but means any functions calling _safeTransferToken() will continue executing. This is similar behavior to phantom functions, an area of research that dedaub previously found a novel security issue with. Because there should be no changes when an amount of zero is involved, reverting will save the user gas and also prevent later logic from executing unexpectedly.

Impact

Informational.

Recommendation

Add more revert code paths for unexpected edge cases, such as _amount == 0 in _safeTransferToken().

5. Informational - Replace modifiers

Exit10.sol has many internal functions that could have been implemented as internal functions instead of modifiers. But two other contracts do implement modifiers. If a modifier is only used once, it may make more sense to inline the logic directly in the function where it is needed. But at a minimum, consistency within a codebase is generally preferred and the modifiers could be converted to internal functions to match the pattern use in Exit10.sol.

Technical Details